EE Bond Value As It Gets Closer To Maturity

January 11, 2021

ee bonds

bonds

[investing]

EE Bonds are interesting. They are bonds guaranteed by the US Government and offered at a minuscule rate, currently at 0.10%. However, the twist is they double in value after 20 years. This means if you hold the bonds for 20 years, the interest rate is about 3.5263%.

The doubling also means the bonds become more valuable over time. Eventually, you may be better off taking a loan or selling stocks just to avoid selling.

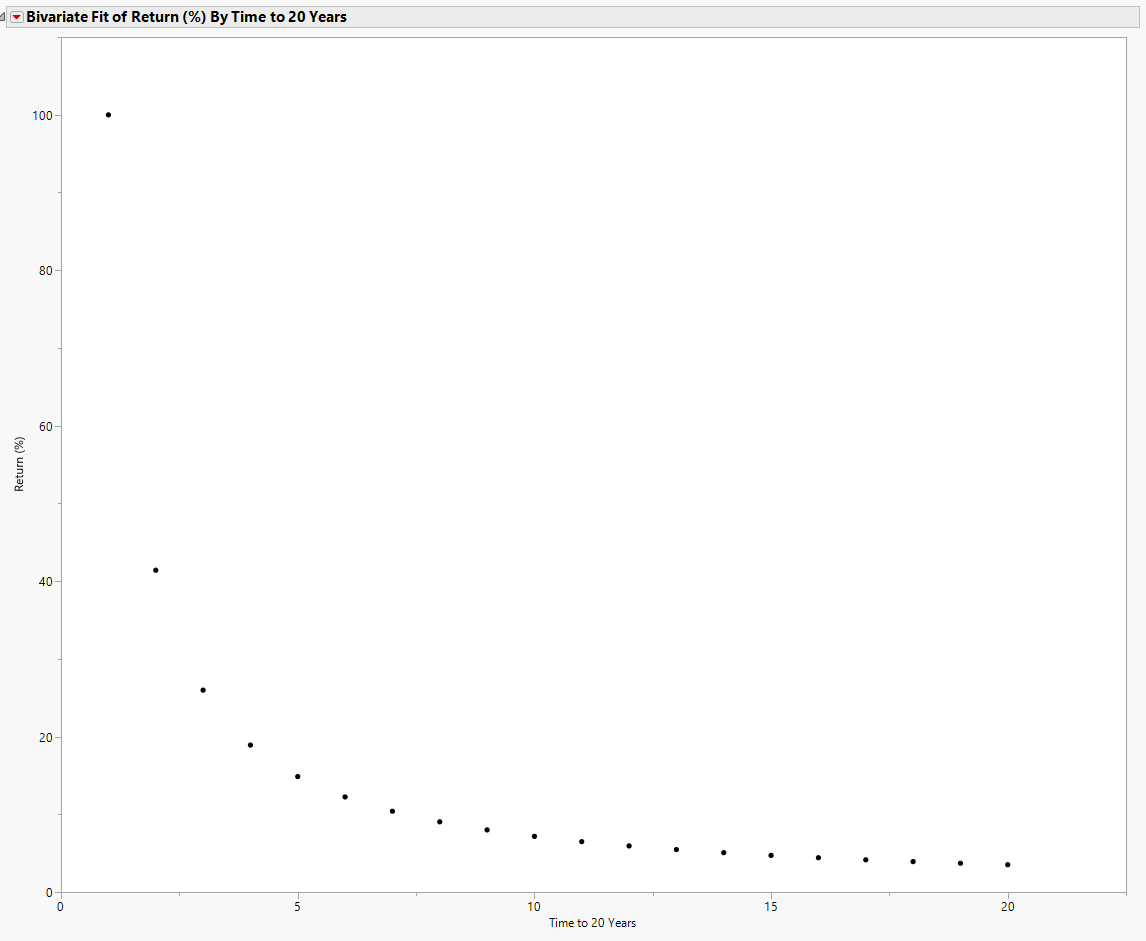

Ignoring the fixed interested which is tiny, the table below shows the interest rate based on years remaining until the bond hits 20 years. After 10 years, waiting another 10 years makes the bond as valuable as the average return of the stock market.

My strategy is to consider them part of my emergency fund for the first 10 years, and be prepared to spend them if necessary because holding stocks will “on average”, give a greater long term return. After that, I’m willing to sell stocks to save the bonds. The bond return is higher, and guaranteed.

| Years Remaining to Reach 20 Years | Return |

| 1 | 100.0% |

| 2 | 41.42% |

| 3 | 25.99% |

| 4 | 18.92% |

| 5 | 14.87% |

| 6 | 12.25% |

| 7 | 10.41% |

| 8 | 9.05% |

| 9 | 8.01% |

| 10 | 7.18% |

| 11 | 6.5% |

| 12 | 5.95% |

| 13 | 5.48% |

| 14 | 5.08% |

| 15 | 4.73% |

| 16 | 4.43% |

| 17 | 4.16% |

| 18 | 3.93% |

| 19 | 3.72% |

| 20 | 3.53% |