The Secret Of Investing

May 8, 2020

investing

saving

[investing]

The secret to investing is time. Long term investing is boring and not stimulating. This is why you don’t hear much about it in the plethora of websites, tv shows, books and other media dedicated to investing.

There is a hyper-focus on short term gains and daily movements because people focus on today instead of where they’ll be n 6 months or 10 years.

I’m sure there is a behavioral finance topic somewhere in this observation.

For me, I started working about 15 years ago in October of 2004. Back then I didn’t have the knowledge I have today. I deduced that contributing to a 401k was a good idea since I wouldn’t have to pay taxes on it. And I had a general sense to save since I grew up poor. I didn’t make a lot but I put away as much as I could every year. And I didn’t mess around with it … mostly.

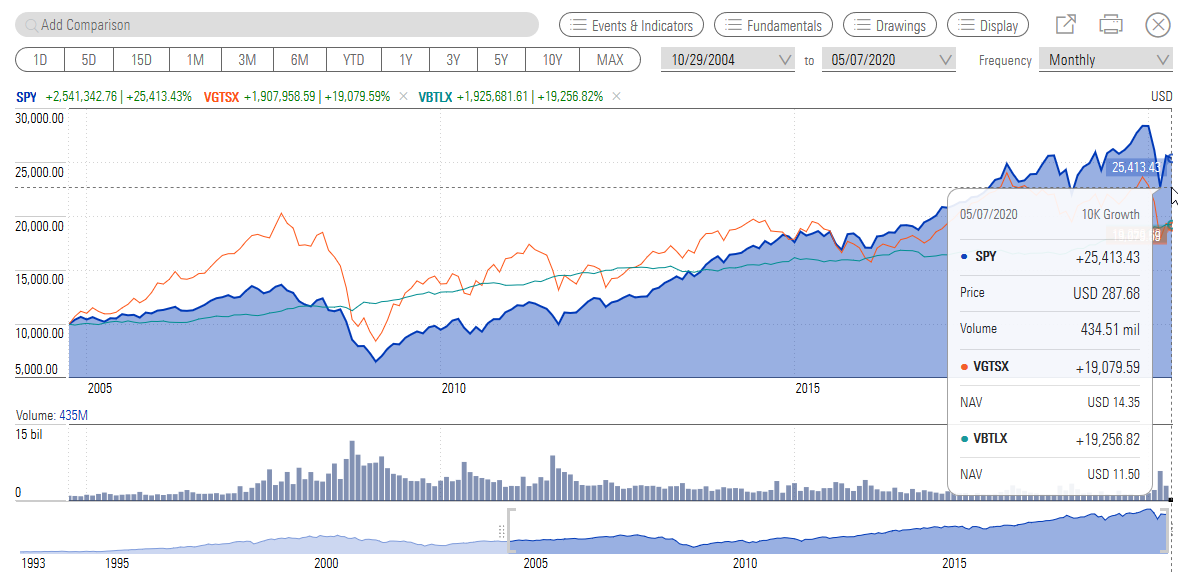

Looking back I see the money I saved way back in 2004 has grown a lot, I’ve almost doubled whatever I put in international(VGTSX) and bonds(VBTLX), and more than doubled my contributions to the S&P fund(SPY). The one weird secret? Time. On the far right you can see the current pandemic panic dip. Its tiny in relation to the entire 15 year chart.

I plan to retire in 20 years and, while its possible for everything to go to zero, I have a feeling things will continue to grow. All I have to do is wait.