Starting Hedgefundie’s Adventure at Interactive Brokers Lite

May 24, 2020

interactive brokers

hedgefundie

[investing]

Today I set up the hedgefundie portfolio at my Interactive Brokers Lite(IBKR) account. Who is Hedgefundie? Hedgefundie is a random guy over on the bogleheads forum who’s posted a portfolio of a 3x leveraged S&P fund and 3x leveraged long duration treasury bonds. The S&P fund gives growth while the treasury bonds balance out the riskiness a.k.a provide risk parity. Hedgefundie and other forum members have done extensive backtesting and generally the strategy works. I mean, as well as any strategy involving driving forward at full speed while looking at the road in the rear-view mirror. The agust minds on the forum have determined there is about 10% chance everything will go to zero and the remaining 90% chance is we’ll become millionaires. Sign me up!

Of course when we’re talking millions its best to do it in a Roth IRA. Because I don’t want to pay taxes on my hypothetical millions. It took me a few days to go through the hoops to set up a backdoor Roth at IBKR. There is a settling time of a few days after a money transfer and the IRA conversion took another day or so. I briefly though about doing this at M1 Finance like hedgefundie advocates. It was a fleeting though that disappeared as soon as I remembered M1’s $25 Roth conversion fee that is an immediate tax of 0.42% on my conversion. And let us not forget the $100 ‘TOD’ fee if I were to pass away. Or the $20 if I didn’t bother to log in for 90 days.

I made sure to enable margin trading when setting up the account. Apparently this will let me borrow against my account while waiting for funds to settle. This makes rebalancing easier because I can buy on the day I sell using the unsettled funds from my sell order. Or so I think.

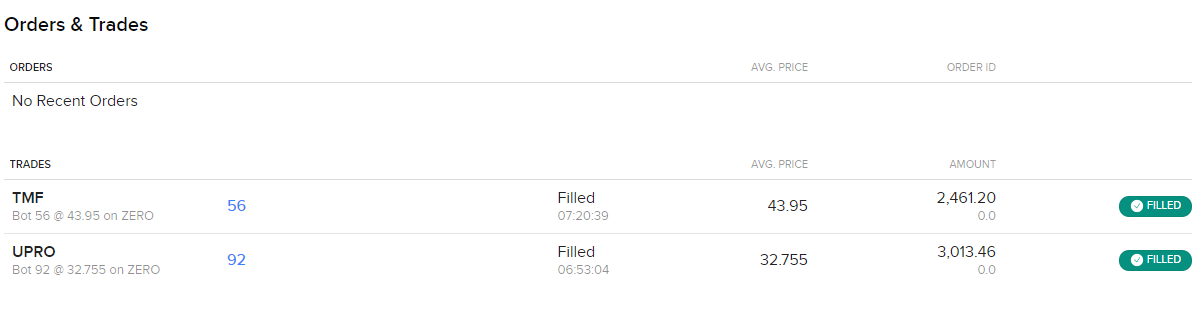

There was some weirdness in the buying. Even though the interface let me enter dollar amounts which led to fractional shares, IBKR only ultimately bought whole shares. And when entering dollar amounts for my second order, I kept getting a message stating I had insufficient funds despite having enough. The error went away when I switched to the shares button and entered a whole amount. I don’t know how that works with their claim of allowing fractional trading. I mean, even the lesser M1 lets me fractionally trade UPRO and TMF.

So because of only buying whole shares I have a UPRO/TMF ratio of 55.04/44.96 instead of the recommended 55/45. I’m supposed to rebalance it quarterly and so I guess I’ll check back in 3 months from now. Stay tuned.