My M1 Finance Pie

May 22, 2020

interactive brokers

m1finance

[investing]

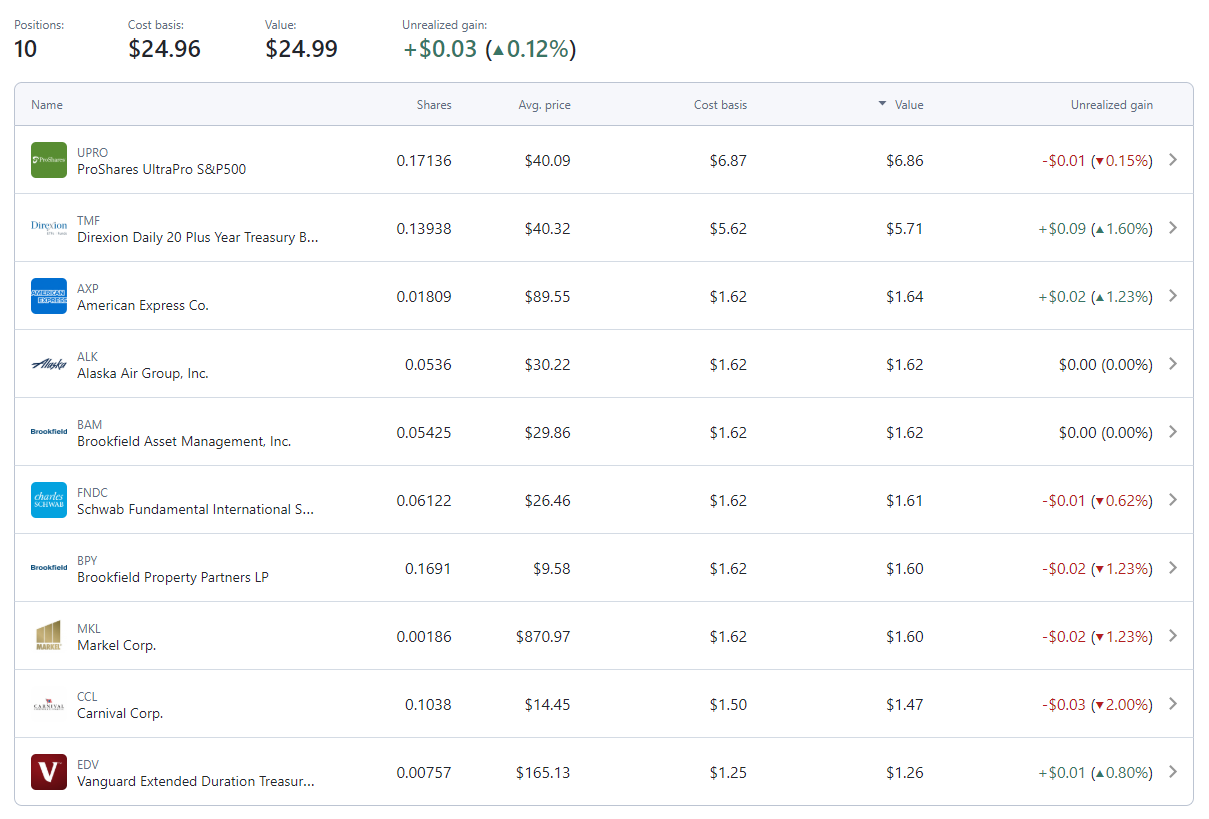

Today lets talk about my M1 Finance Pie. My M1 Finance Pie into which I’ve invested a grand total of $25 is split into two slices - Outta Control and Going To Zero.

Outta Control is a copy of the hedgefundie portfolio which a 55/45 ratio of UPRO, a 3x leveraged S&P fund, and TMF, a 3x leveraged long duration treasury fund. Looking through the threads on the bogleheads forum, I think I have a 10% chance of losing it all and a 90% chance of becoming a multi-millionaire. So I have bet 1/2 my money or about $12.50 on it.

My other $12.50 is bet on Going To Zero. Here I’ve picked leaders of the industries hit by the Cornoavirus shutdowns like airlines, cruise lines, real estate, and lending. As a contrarian I feel people will pile into using these industries once a cure is found. Just for fun I added some long duration bonds, VDE, for stability and threw in an international small cap value fund. You know, because international, small cap, and value is a combination of the three worst things to be in today.

I completely expect this portfolio to go to zero. This is why I referred to my investments as ‘bets’. In fact, I’d be surprised if it didn’t go to zero. I also plan to rebalance randomly whenever I get bored.

To get on board with the other shills, please consider using my referral link. I’ll get $10 and you’ll also get $10 to start. I’ve only put in the minimum investment of $25 and you can see the fun I’m having with just that.